T2 Continues a Strong Year of Lending

T2 Capital Management, LLC is pleased to announce three recent loan closings via the T2 Strategic Real Estate Income Fund (SREI). The land and acquisition loans, which totaled over $28.7 million, showcases T2’s flexibility and ability to close in a time of market volatility.

A $9.4 million loan funded the acquisition of a 25-unit residential building located in the Streeterville neighborhood of Chicago, IL. The property had been underperforming with below market rents due to absentee ownership. Renovations and new management are planned for the building.

A $14 million loan recapitalized a development site located in the Fulton Market neighborhood of Chicago. The borrowers are in the process of obtaining construction financing for the construction of a high density multi-family residential tower.

T2 Capital Management, LLC is pleased to announce three recent loan closings via the T2 Strategic Real Estate Income Fund (SREI). The land and acquisition loans, which totaled over $28.7 million, showcases T2’s flexibility and ability to close in a time of market volatility.

A $9.4 million loan funded the acquisition of a 25-unit residential building located in the Streeterville neighborhood of Chicago, IL. The property had been underperforming with below market rents due to absentee ownership. Renovations and new management are planned for the building.

A $14 million loan recapitalized a development site located in the Fulton Market neighborhood of Chicago. The borrowers are in the process of obtaining construction financing for the construction of a high density multi-family residential tower.

T2 Capital Management, LLC is pleased to announce three recent loan closings via the T2 Strategic Real Estate Income Fund (SREI). The land and acquisition loans, which totaled over $28.7 million, showcases T2’s flexibility and ability to close in a time of market volatility.

A $9.4 million loan funded the acquisition of a 25-unit residential building located in the Streeterville neighborhood of Chicago, IL. The property had been underperforming with below market rents due to absentee ownership. Renovations and new management are planned for the building.

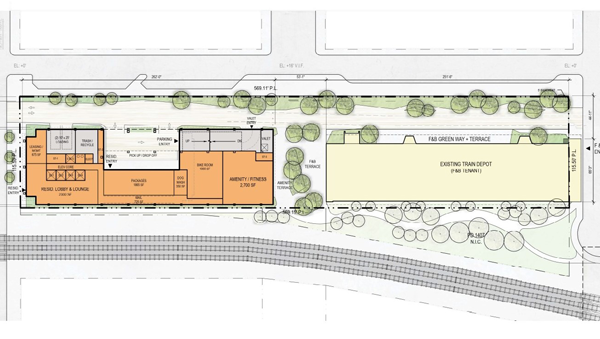

A $6.87 million loan financed the acquisition of several small industrial buildings and excess land. The excess land is zoned for a multifamily development which the borrowers will pursue, while the balance of the property will remain industrial, leased out to multiple tenants.

Dan Van Prooyen, Chief Lending Officer at T2 Capital Management, commented, “Acquiring commercial real estate is becoming increasingly difficult in this new rate climate. Many financial institutions have paused lending during this time of volatility. T2 is delivering loans with confidence and no surprises. The T2 team continues to set itself apart with agility, integrity, transparency, and the certainty of execution that has made SREI a trusted financial partner to real estate professionals nationwide.”

Headquartered in suburban Chicago (Wheaton), T2 serves as a balance sheet lender that has financed multiple projects throughout the USA including current projects in over 15 states. To find out more about debt financing or investment opportunities available with T2 Capital Management, visit T2investments.com.

About T2 Capital Management: T2 is a growing private equity real estate firm that is based in Chicago. Since its inception in 2011, T2 has deployed $1.25+ billion and currently manages $500+ million across multiple investment strategies.